In recent years, even before COVID-19, bars, restaurants, business—and customers—have been trending towards fully cashless transactions. Between 2011 and mid-2016, a Gallup survey found that 12% of Americans reported they didn’t use cash at all. More customers are also using credit and debit cards for small purchases like lattes or cocktails. According to an analysis by Square, a payments and financial services company, in 2019 50% of consumers used cards for as little as a $4.50 purchase.

Benefits of a Cashless Bar

A cashless bar system offers many benefits for both customers and bar operators.

Faster Service

“Getting rid of cash makes the customer experience as frictionless and streamlined as possible,” says David Silverglide, co-founder of Split Bread. Customers no longer waste time fumbling for bills or coins, and employees don’t need to make change. Travas Clifton, owner of ModCup Coffee in New Jersey also discovered that going cashless “saved a tremendous amount of time on the accounting side of things, for the manager at the end of the night.”

Reduced Crime

Cashless transactions lessen the likelihood of cash register robberies. When the University of Missouri monitored crime rates from 1990-2011 it concluded that going cashless reduced statewide crime by 9.2%. Cashless bar employees will also stay safer as they won’t have to transport cash to bank deposit boxes late at night.

Better Budgeting

Having a digital record also helps bar owners and operators keep tabs on spending for taxes and other accounting purposes. Using modern analytical apps, tools, and custom POS systems, they can budget better and avoid unaccounted spending.

Fewer COVID-19 Concerns

“Perceptions that cash could spread pathogens may change payment behavior by users and firms,” concluded the Bank for International Settlements in a study on the effect of Covid-19 on cash use. In other words, while there may not be medical evidence that cash transmits the virus, cautious customers are still choosing contactless payment methods. National governments across the globe echo their concern. The Federal Reserve introduced a process of quarantining money, while The Reserve Bank of India advised people to use electronic payments.

Cashless Bar Cons

Of course, there are a few drawbacks of having a completely cashless bar.

Customers Without Cards

The FDIC counts 9.2 million unbanked or underbanked households in the US. That means customers without credit or debit cards. Other customers are too young to have cards.

A Park Café employee told the Baltimore Sun “There’s a lot of children who come in all the time… sometimes they want a cookie, and it would break my heart if we couldn’t provide that to them.” Pieces restaurant and game bar owner Laura Leester echoes that sentiment. After seeing the frustration of cash customers, she said ”As a responsible business owner and someone who wants to share my goods and services with all socio-economic levels, I felt it was my duty to start accepting cash”.

Government Restrictions

Last spring, New Jersey passed legislation banning cashless businesses. Similar legislation was proposed in New York City, San Francisco, and Washington D.C. So upgrading to a completely cashless bar may not be an option yet, if your city follows suit.

Cashless Bar Tech

With the right tech, going cashless can save money and increase transactions. According to payment processing company Shift4 Payments, as of September 15, 2020 restaurant transactions were up over 190%. “This data suggests that restaurants, bars, and hospitality businesses have successfully adapted to the situation by implementing social distancing practices, contactless payments, online ordering, QR Pay, and other measures…” says Shift4’s vice president of marketing. Wondering which cashless tools are best for your bar? We’ve highlighted some top tech for COVID-19 and beyond.

Tablet Table Service

Tablets and mobile phone tools like BarPay make contactless ordering and payment easy with a quick scan of a QR code.

Website to Curbside

Shift4’s web solution SkyTab, allows bar patrons to order and pay online for takeout or delivery. It’s not only safer, it’s more convenient for customers who value their time. You could also create your own mobile transaction app and improve your brand equity and loyalty.

Outdoor Cocktails

Hosting an outdoor bar event? British company Tappit offers wristbands and apps connected to credit cards for cashless transactions at festivals, sporting matches and other events with large crowds.

Shopify, Clover and More Cashless Solutions

Beyond Apple Pay, PayPal and the cashless solutions you’re familiar with, Shopify, Clover and a host of other cashless payment systems are now available. When choosing a solution for your cashless bar, make sure it includes the following essentials.

- Mobile capabilities

- Offline functionality

- Email receipts

- Strong security

- eCommerce integrations

- EMV and NFC (electronic payment standards)

- Social-distancing options (curbside pickup, kiosk mode, QR codes, etc.)

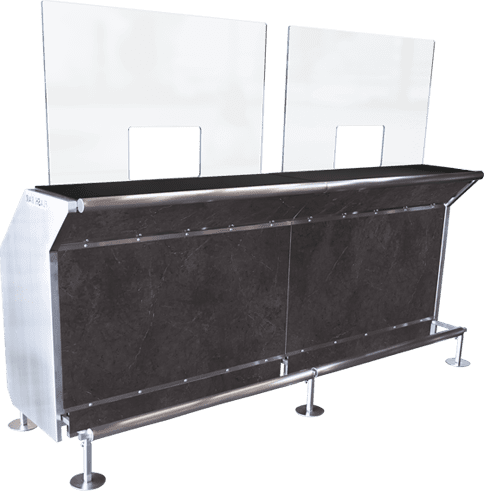

A Tech-Ready Bar

Once you’ve found the right tech for your cashless bar, you’ll need somewhere to stash those wireless routing cables so they don’t trip up your employees. Our versatile portable bars have a gap between the working surface and the back of the front panel. We designed this space so you can keep routing cables safely tucked away.

Keep Your Bar Business Booming

Want to keep your bar business booming during the COVID-19 outbreak and beyond? So do we! Follow The Portable Bar Company blog and we’ll help you stay on top of the latest industry news, trends and tips.